Personal representatives accept a weight of trust and level of legal obligation not for the faint-of-heart. Whether named in the will or appointed by the court, duties placed upon them require a delicate balance balance to the interests of both the deceased and beneficiaries. A perceived failure to abide in good faith to the interests of the deceased can provide a basis for interested parties to object and seek replacement. In some cases, these obligations involve other areas of law.

Sample duties and obligation

Common duties of a personal representative, also known as an executor when named in a will, include an accounting of the assets, i.e., paying the estate’s final bills and taxes, and distributing remaining assets to the beneficiaries as intended. State laws list specific criteria to serve as an executor, such age, mental capacity and even absence of a criminal record. Judges and courts can appoint a personal representative, or an administrator, when the decedent has not prepared a will. State laws identify who has rights as heirs to the estate.

Interested parties can affect the length of service

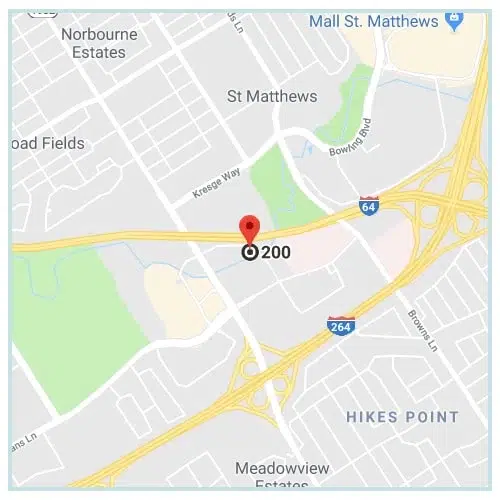

A recent court case in Kentucky exemplifies how personal representatives must fulfill their duties in good faith on behalf of the decedent. A loan services company sought to foreclose upon the property owner in September of 2019. The summons and complaint failed to reach the owner owing to his death later in the month. The company amended the complaint against the decedent’s parents. The trial court granted the parents’ two motions. One dismissed the complaint since the company failed to revive the action against the personal representative.

The court reviewed the company’s appeal on this and other issues and reversed. The company did not have to revive the action under the specific statute against the personal representative because the claim against the mortgage passed with the property. Furthermore, the deceased never had an action brought against him in the absence of service. The case returned to the lower court for further proceedings.

Whether named or appointed, personal representatives remain bound to fulfill duties until the close of the estate. Those ill-suited to the position can create long-lasting legal and costly financial headaches to all interested parties. Attorneys who understand how personal representatives fit into an estate planning framework can provide guidance.