Life Care Planning

Life Care Planning: Crucial For Your Future

Life care planning, simply put, is a holistic approach to coping with challenges of long life or long-term disability. The practice of life care planning involves identifying present and potential future care needs, locating appropriate care and making connections to resources to promote high-quality care.

The goal of life care planning is to promote and maintain the health, safety, well-being and quality of life of elders or those living with long-term disabilities. Kentucky ElderLaw, PLLC, helps families understand the natural progression of aging and its impact on a loved one’s health, mobility, housing and financial resources.

What Services Does A Life Care Plan Include?

Life care plans are customized to meet the needs of the individual and family. Services include legal services, care coordination, client advocacy, and Medicare and insurance support.

Who Is A Good Candidate For A Life Care Plan?

A life care plan is appropriate for individuals who are coping with chronic illnesses or aging. A life care plan is also needed for individuals who are disabled in other physical, cognitive or developmental ways.

When Is The Right Time To Create A Life Care Plan?

The right time is when an issue arises that leaves you concerned about your loved one’s future care. If a person’s condition is deteriorating or her care is becoming a strain for the family, it’s time to make that call to our firm. Issues to consider are a diagnosis, a catastrophic accident, a medical event, a concern over current care or the stress load of the current caregiver.

It is best to consider a life care plan before you are in a crisis situation. You will be more at ease if you make these plans and arrangements in advance without having to rush through the planning process while also having to deal with the stress of caring for your loved one.

When To Start Estate Planning

Many of our clients have a common question: When should I start the estate planning process?

It is important to remember that estate planning is a customized process. There is no one-size-fits-all approach. When we meet with clients, we look at many things; their goals, their families, their finances, and their lives.

So could estate planning begin when a young couple has their first child? Yes. When a divorced individual gets remarried? Certainly. When a couple nearing retirement wants to review their plans to make sure it is congruent with their upcoming change in employment status? Absolutely.

You can start estate planning at any age or life stage in adulthood. Your needs will vary based on many factors, so it is important to work with an experienced attorney who can help you create a plan that works for you.

Embarking on the journey of life care planning requires informed decisions and guidance. At Kentucky ElderLaw, we understand the complexities involved in securing comprehensive care for you or your loved ones.

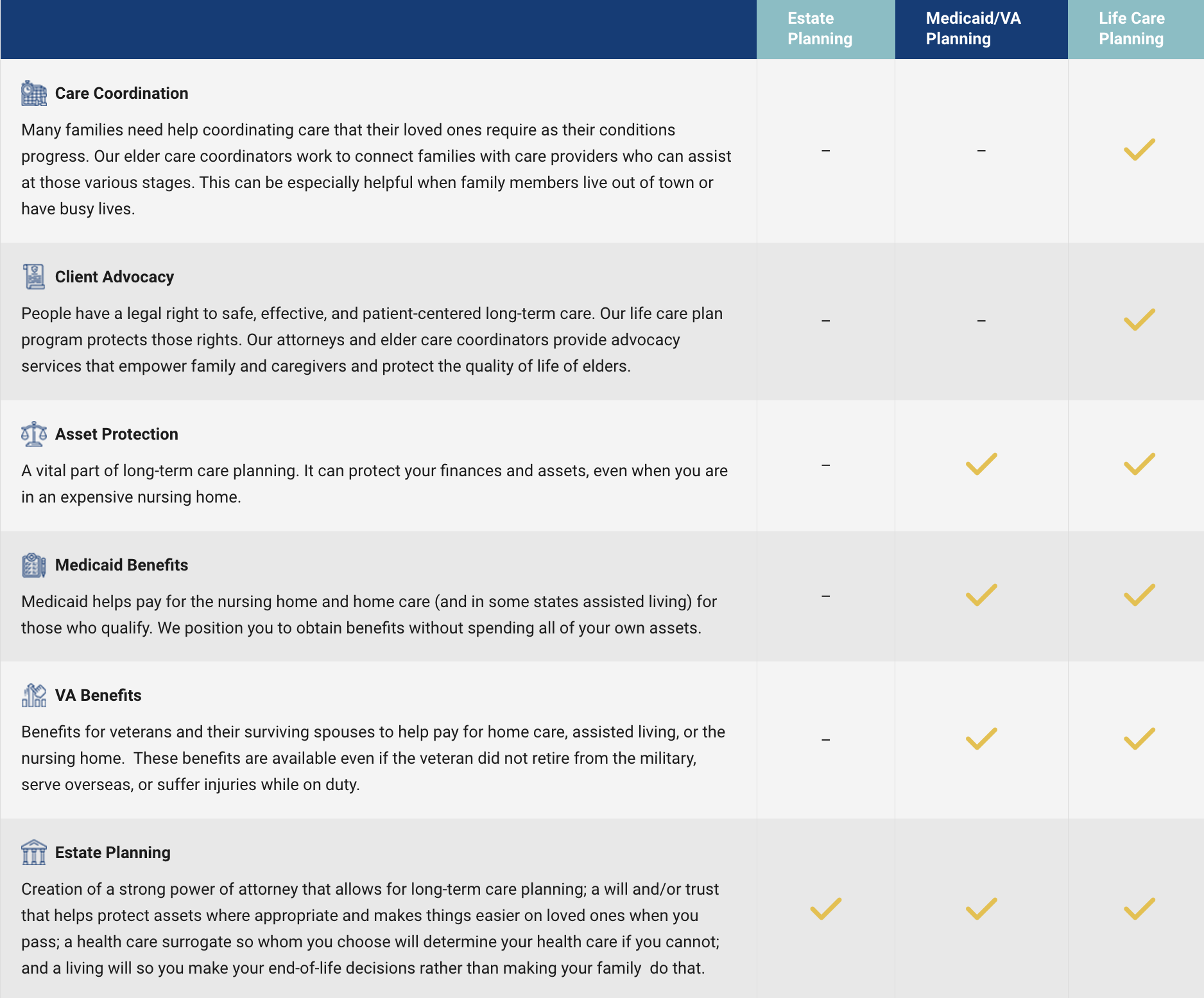

Our life care planning services encompass a holistic approach to help address the RIGHT services for you. Explore the chart below for an overview of our life care planning options and what they cover. Our team is here to guide and support you through every phase of this essential journey.

Get A Free Consultation About Life Care Planning

If you are ready to begin life care planning for yourself or on behalf of a loved one, call Kentucky ElderLaw, PLLC, today for a consultation. You can reach our Louisville office at 502-581-1111, our Bowling Green office at 270-467-0002 or our Shepherdsville office at 502-955-1005. You can also send our office an email.