Medicare

Medicare: Does It Cover Nursing Home Costs?

In the context of nursing home care, Medicare is a minimal player for long-term care, paying only about 8 percent of nursing home costs. This leaves many patients financially strained. The attorneys at Kentucky ElderLaw, PLLC, can help you understand how Medicare will affect your finances if you need to stay in a nursing home. We work with clients in Kentucky and Southern Indiana to help them plan their nursing home stays, manage their finances and know their rights regarding Medicare.

Defining Medicare

Medicare is a federal insurance program that pays for hospitalization (Part A), doctors (Part B), Medicare Advantage (Part C) and prescriptions (Part D). Almost everyone who pays the FICA withholding out of their paychecks will receive Social Security, and will be eligible for Medicare supplement insurance. Note that while the Social Security retirement age is now 66, Medicare still starts at age 65. Early retirees – those taking Social Security at age 62, 63 and 64 – are not eligible for Medicare until age 65.

Understanding Medicare, Hospitalizations And Coverage

If a Medicare-eligible person has been hospitalized for three consecutive nights and then receives a rehabilitative discharge, Medicare will pay for up to 20 days of nursing home care if she enters a nursing home within 30 days of discharge. Most people go directly from the hospital to the nursing home.

After the first 20 days, there is the potential of an additional 80 days available. In order for Medicare to pay for any part of the 80 days, the rehab must be helping the person maintain and preventing decline. Medicare terminates as soon as the resident stops maintaining. Expect no more than 24 hours’ notice from the nursing home prior to Medicare termination. Additionally, there is a very large copay for any part of the 80 days received – $170.50 per day for 2019. Some Medicare supplements will pay the copay in part or in full, and some will not.

Most nursing home residents do not receive the full 80 days of additional coverage, especially those admitted with cognitive issues since they often cannot fully participate in rehab. Once Medicare ends, the choices are private pay at around $9,000 per month, long-term care insurance (which most older folks do not have) and Medicaid.

Ask Your Questions In A Free Consultation

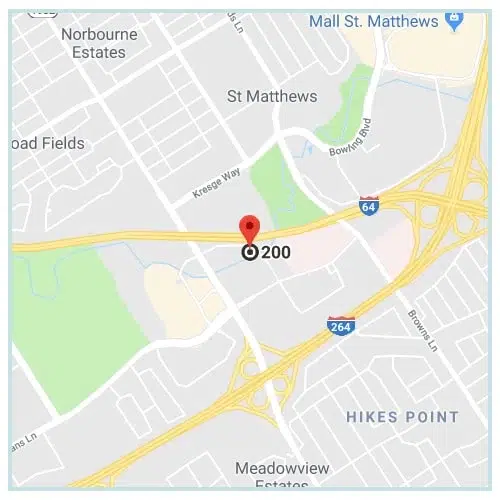

Medicare is complicated. A friendly attorney from Kentucky ElderLaw, PLLC, can help you determine what Medicare will cover should you need long-term care. You can reach our Louisville office at 502-581-1111, our Bowling Green office at 270-467-0002 or our Shepherdsville office at 502-955-1005. You can also send our office an email.