Long-Term Care Planning

Plan Your Future With A Long-Term Care Plan

According to the U.S. Department of Health and Human Services Administration on Aging, someone in the U.S. who is turning 65 years old has a 70 percent chance of needing long-term care at some point in their lives.

Considering that more than two-thirds of the population over 65 will likely need long-term care, it is important to understand exactly what long-term care planning involves.

What Is Long-Term Care Planning?

Planning for the future of your financial and medical needs is commonly referred to as long-term care planning. This process is typically very complex and solutions vary from person to person. A long-term care plan can be customized to address the short- or long-term needs of an individual.

People often find it advantageous to work with an elder law attorney throughout this process.

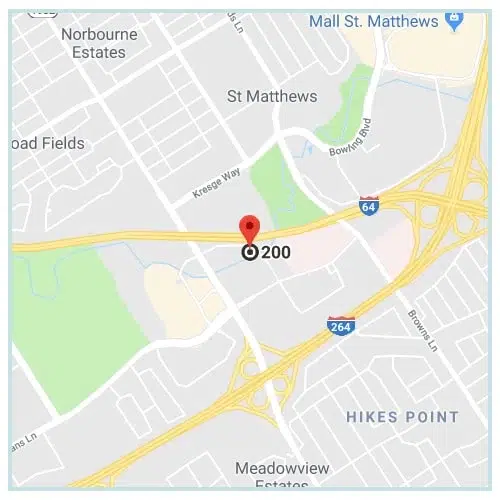

Kentucky ElderLaw, PLLC, located in Louisville and Bowling Green, can help ensure that your medical and financial wishes are documented and fulfilled.

What Do Long-Term Care Plans Cover?

While every plan is different depending on the unique needs and life circumstances of the individual, long-term care plans often cover:

Why Long-Term Care Planning?

No one can predict the future. But the fact is, a large percentage of older adults will need long-term care at some point in their lives. The chances of needing long-term care go up for individuals with chronic illnesses. Lifestyle factors choices can have an effect.

Taking steps now to plan for the future can provide individuals and families with peace of mind. A long-term care plan allows individuals to map out a customized plan, so important decisions do not have to be made in haste in the future.

Talk to an attorney to find out about your specific options.

Get A Free Consultation With A Lawyer

What are the long-term care planning essentials? Start discussions with an attorney from Kentucky ElderLaw, PLLC, today. We will work with you every step of the way.

Reach our Louisville office at 502-581-1111, our Bowling Green office at 270-467-0002 or our Shepherdsville office at 502-955-1005. You can also send our office an email.