Kentucky families who want to be prepared for anything are likely to create an estate plan to determine where their assets and wealth will go after they die. One of the most important choices that is made as the will is set up is who will be the executor of the estate. This is not a small job, nor is it necessary for a corporation or a financial wizard to handle it. Choosing the right executor depends on the family’s situation, family dynamics and how big the estate is.

According to AARP, there are benefits to choosing a corporate trustee to handle an estate. Corporate trustees can be financial service firms or banks and the benefit is that they are likely to be around to outlive the trust. The negative is that they are typically more expensive than a private executor and there is an impersonal nature about the transaction. They are also held accountable to shareholders which can affect how an estate is handled.

FindLaw lists several options for who can be an executor including children, siblings and spouses. Almost anyone can be an executor of a will if they are organized, honest and communicate openly. Any executor cannot be under the age of 18, cannot be a felon and must meet all state requirements.

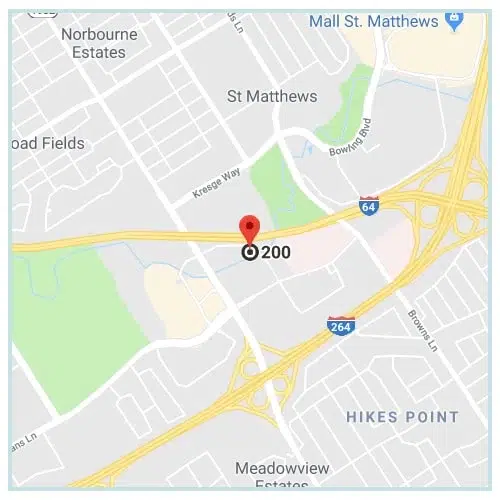

When choosing an executor, an individual also wants to consider the location of the person. The executor will be tasked with paying bills and taxes for the estate, maintaining the property until things are settled, distributing assets and making court appearances. If the person does not live close or cannot travel to do those things, they may not be the best choice.

Much of choosing an executor is a personal decision based on the specific estate. Those who want to create an estate plan or need advice choosing an executor may benefit from speaking to an attorney first.